Climate

The climate of Kerala, as per Koppen's classification, is tropical monsoon with seasonally excessive rainfall and hot summer except over Thiruvananthapuram district, where the climate as tropical savana with seasonally dry and hot summer weather. The entire state is classified as one meteorological sub division for climatologically purposes. The year may be divided into four seasons. The period March to the end of May is the hot season. This is followed by Southwest Monsoon season that continues till the beginning of October. From October to December is the Northeast Monsoon season and the two months January & February winter season. The climate is pleasant from September to February. Summer months March to May is uncomfortable due to high temperature and humidity. The State is extremely humid due to the existence of Arabian Sea in the west of it.

Wind:The winds over the State are seasonal only in the region of Palghat Gap where winds are predominantly from the east in the period from November to March and from west in the rest of the year. In other parts of the State flow of wind is mainly governed by differential heating of land and water mass together with mountain winds. Winds have westerly component during the day and easterly components during the night through the year. In general winds are quite strong during afternoons when the thermal circulation is best developed and weak during night.

Humidity: As the State stretches from north to south with the Arabian Sea in its west, relative humidity is in general high over the State. In the period January to March afternoon humidity reduce to 60-63%, varying from 35% in the interior to 71 % in the coastal area. The diurnal variation in relative humidity during this period is maximum and ranges from 4 to 16%, depending upon the proximity of the sea. The relative humidity in the monsoon period rises to about 85% for the state. The variation in this period is minimum.

Temperature:Day temperatures are more or less uniform over the plains throughout the year except during monsoon months when these temperatures drop down by about 3 to 5°C. Both day and night temperatures are lower over the plateau and at high level stations than over the plain. Day temperatures of coastal places are less than those of interior places. March is hottest month with a mean maximum temperature of about 33°C. Mean maximum temperature is minimum in the month of July when the State receives plenty of rainfall and the sky is heavily clouded. It is 28.5°C for the State as a whole in July, varying from about 28°C in the north to about 29°C in the South. Inland stations experience higher maximum temperatures than the coastal stations. From May onwards both the maximum and minimum temperatures start falling, the latter very rapidly while the former slowly.

Rainfall: The total annual rainfall in the State varies from 360 cm. over the extreme northern parts to about 180 cm. in the southern parts. The southwest monsoon (June-October) is the principal rainy season when the State receives about 70% of its annual rainfall. Monsoon rainfall as percentage of annual rainfall decreases from north to south and varies from 83 % in north most district of Kasaragode to 50% south most district of Thiruvananthapuram. Northeast monsoon rainfall as percentage of annual rainfall increases from north to south and varies from 9% in north most district of Kasaragode to 27% in south most district of Thiruvananthapuram. The rainfall amount in the State decreases towards the south with decrease of height of Western Ghats . The southern most district of Thiruvananthapuram where Western Ghats are nearest to the sea coast and its average height is also least in the State receives minimum amount of rainfall. The thunderstorm rains in the pre-monsoon months of April and May and that of monsoon months are locally known as 'EDAVAPATHI'. Rainfall during northeast monsoon season is known as 'THULAVARSHAM' in local language. The southwest monsoon sets-over the southern parts of the State by about 1 st June and extends over the entire State by 5th June. June and July are the rainiest months, each accounting individually to about 23% of annual rainfall.Monthly distribution of Normal and Actual rainfall of Kerala state for last ten years .

The diversity of the geographical features of the state has resulted in a corresponding diversity in climate. The High Ranges have a cool and bracing climate throughout the year, while the plains are hot and humid. The average level of annual rainfall is quite high when compared to other Indian states. The state basically enjoys 4 types of climate such as Winter, Summer, South West Monsoon and North East Monsoon.

Winter Season in Kerala

In Kerala the winter season starts when the northeast monsoons ends. That is from the month November till the middle of February. During this time, the temperature is less but it does not have much difference with the other seasons. The temperature remains cool constantly throughout the year in the highlands but the winter temperatures falls below 10°C. It is during this winter season that we receive some of the lowest amount of rainfall.

|

Average Temperature during Winter in Kerala:

|

Maximum: 28°C

Minimum : 18°C

|

|

Average Rainfall during the season :

|

25 mm

|

Summer Season in Kerala

The temperature starts to increase with the end of February which indicates the beginning of summer in Kerala. The characteristics of summer in Kerala are relatively higher temperature, less rainfall and humid weather. The other Indian states have a temperature of about 40°C, whereas in Kerala it is comparatively cool and pleasant. It is mainly because of the presence of the Western ghats that prevents the northern wind from entering our state. The Arabian sea bordering us that gives a cool breeze which helps to make the temperature moderate. Another important feature of this season is the arrival of rain which is accompanied by thunder and lightening. The summer season extends from March till May or the beginning of June. It ends with the beginning of monsoon.

|

Average Temperature during Summer in Kerala:

|

Maximum : 36°C

Minimum : 32°C

|

|

Average Rainfall during the season :

|

135 mm

|

South West Monsoon in Kerala

The rainy season in Kerala is the Southwest monsoon. In malayalam this season is called as Edavappaathi which means in the middle of the malayalam month Edavam. It is called so because the rain starts by the middle of this month that is the end of May or early June. The following two months have torrential rain. As Kerala lies on the windward side of the Western Ghats and is the first state to get hit by the monsoon winds, this state receives heavy rainfall. It is the monsoon that provides almost 85% of the rains. The slopes of the Western Ghats receive the highest amount of rain. The rivers get flooded by the monsoons. This season continues till the end of September.

|

Average Temperature during this season :

|

Maximum : 30°C

Minimum :19°C

|

|

Average Rainfall during the season :

|

2250-2500 mm

|

North East Monsoon in Kerala

The North east monsoon is also known as the Retreating Monsoon or the Reverse monsoons. This hits Kerala when the southwest monsoon winds take their return. These rains are called as Thulavarsham in malayalam because it rains during the malayalam month thulam. It comes in the month October and November and at times continues up to December. The main feature of this season is heavy rains during afternoon together with lightening and thunder. The days are usually warm and humid without much variation in temperature.

|

Average Temperature:

|

Maximum : 35°C

Minimum : 29°C

|

|

Average Rainfall during the season :

|

450-500 mm

|

There has been a great change in the climatic condition of the Earth in the past few years. This has affected the weather conditions in Kerala also.

|

Average monthly rainfall in Kerala

|

|

Month

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Jul

|

Aug

|

Sep

|

Oct

|

Nov

|

Dec

|

|

Rainfall (mm)

|

14.6

|

16.6

|

36.1

|

110.9

|

252.6

|

653.2

|

687.2

|

404.7

|

252.3

|

270.7

|

158.6

|

45.9

|

Monsoon 2023

The pre monsoon rainfall received in the State from March 1, 2023 to May 31, 2023 was categorised as ‘deficient ’ with a departure of (-)34 per cent from the normal. The average actual rainfall received was 241 mm against the normal of 364 mm. Normal rainfall was received only in Pathanamthitta and Wayanad Districts while in the remaining Districts, it was deficient.

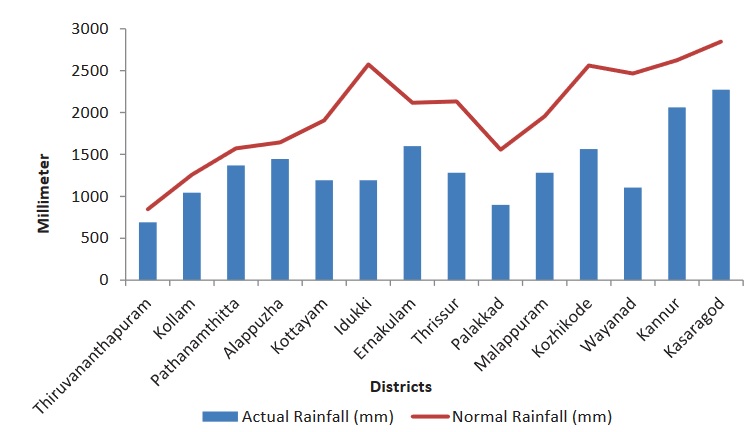

In 2023, the Southwest monsoon reached Kerala on 8th June, 7 days after the normal date of onset over the State. The actual rainfall received in Kerala in the South West Monsoon season (June 1, 2023 to September 30, 2023) was ‘deficient’ receiving 1326.5 mm as against the normal rainfall of 2018.6 mm. This was a departure of (-) 34 per cent from the normal. Southern Districts of Thiruvananthapuram, Kollam, Pathanamthitta and Alappuzha received normal rainfall in 2023, while in the remaining Districts rainfall received was deficient. Kasaragod District received the highest rainfall 2272.4 mm (Figure 3.1.1). Withdrawal of the SW-monsoon 2023 began on 25th September against the normal date of 17th September. It can be noticed that Kerala was deficit in winter, pre monsoon and south west monsoon in 2023.

(Fig 3.1.1) South West Monsoon Rainfall received from June 01 to September 30, 2023

(Source: Indian Meteorological Department 2023)

The forecast of rainfall during October to December 2023 indicates normal to above normal rainfall over many areas of northwest India and south peninsular India. The rainfall averaged over south peninsular India during the period is most likely to be normal (88-112% of long period average).The LPA of south peninsular India during the period is about 334.13mm.

District-wise rainfall distribution in the State in 2022 is given as here

Monsoon 2024

Kerala received normal rainfall during the two principal seasons which are South-West Monsoon from June, 1 to September, 30 and North-East Monsoon from October, 1 to November, 30. District-wise data on the rainfall received in Kerala during the 4 main seasons of the year are given below:

.jpg)

There are notable variations across Districts in the occurrence of rainfall, with some Districts showing deficiency from the normal and others had excess rainfall. The graphical depiction of actual and normal rainfall in different Districts during the main South-West Monsoon period is given here:

.png)

The Districts of Alappuzha, Idukki, Ernakulam and Wayanad reported deficiency in rainfall (more than 20 per cent departure from the normal) during South West Monsoon period. The withdrawal of the South West Monsoon 2024 commenced on September 23, delayed by 6 days from its normal withdrawal date of September 17.

Source

Economic Review 2013-2024, IMD Thiruvananthapuram