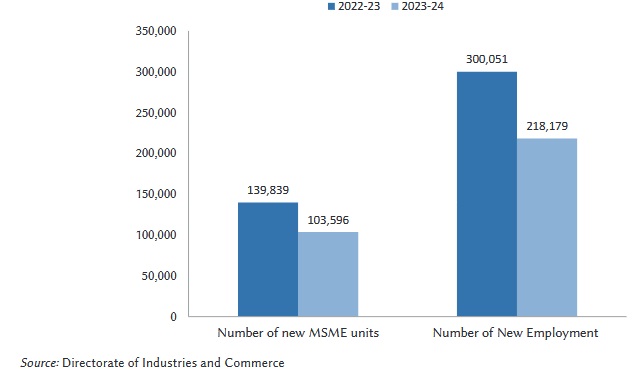

The State achieved remarkable surge in the number of new MSME units established in 2023-24. A total of 1, 03,596 new MSME units were set up in 2023-24 with investment of Rs.7, 048.65 crore. These units have created employment opportunities for 2,18,179 individuals, marking a sustainable expansion in the MSME sector. The details of new MSME units for the last five years are given below:

|

Achievement in MSME sector, 2018-19 to 2023-24 (As on March 31, 2024)

|

|

Year

|

No. of MSME units

|

Investment

(in Rs crore)

|

Employment

(in number)

|

|

2018-19

|

13826

|

1321.94

|

49068

|

|

2019-20

|

13695

|

1338.65

|

46081

|

|

2020-21

|

11540

|

1221.86

|

44975

|

|

2021-22

|

15,285

|

1,535.09

|

56,233

|

|

2022-23

|

1,39,839

|

8,421.63

|

3,00,051

|

|

2023-24

|

1,03,596

|

7,048.65

|

2,18,179

|

|

Total

|

2,97,782

|

20,888

|

7,14,587

|

|

Source: Directorate of Industries and Commerce

|

The number of new MSME units and employment provided for the last two years is shown below:

Number of new Micro, Small and Medium units and employment created in MSMEs in 2022-23 & 2023-24

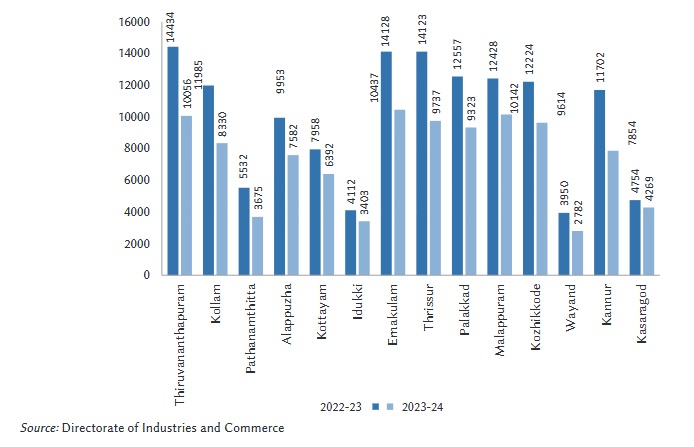

In 2023-24, the district with the largest numbers of new MSME units was Ernakulam (10,437 units) with an investment of Rs 1,013.77 crore, generating 25,387 employment opportunities, followed by Malappuram (10,142 units) with an investment of Rs 742.14 crore generating 23,529 employment opportunities and Thiruvananthapuram (10,056 units) with an investment of Rs 518.62 crore providing employment to 19,550 persons. Wayanad (2,782 units) had the lowest number of new enterprises (2782 units) with an investment of 212.18 crore generating employment for 6,004 persons. The district-wise details of new MSME units started in Kerala in 2023-24 is given below:

|

District wise details of new MSME units started in Kerala during 2023-24

|

|

Sl No

|

District

|

No of MSME units

started

|

Total Investment

( `Crores)

|

Employment generated

(Nos)

|

|

1.

|

Thiruvananthapuram

|

10056

|

518.62

|

19550

|

|

2.

|

Kollam

|

8330

|

504.44

|

17198

|

|

3.

|

Pathanamthitta

|

3675

|

197.36

|

7038

|

|

4.

|

Alappuzha

|

7582

|

434.49

|

14331

|

|

5.

|

Kottayam

|

6392

|

419.8

|

12367

|

|

6.

|

Idukki

|

3403

|

247.12

|

7399

|

|

7.

|

Ernakulam

|

10437

|

1013.77

|

25387

|

|

8.

|

Thrissur

|

9737

|

615.54

|

19993

|

|

9.

|

Palakkad

|

9323

|

616.98

|

20365

|

|

10.

|

Malappuram

|

10142

|

742.14

|

23529

|

|

11.

|

Kozhikode

|

9614

|

679.15

|

20665

|

|

12.

|

Wayanad

|

2782

|

212.18

|

6004

|

|

13.

|

Kannur

|

7854

|

521.65

|

15685

|

|

14.

|

Kasaragod

|

4269

|

325.41

|

8668

|

|

Total

|

103596

|

7048.65

|

218179

|

|

Source: Directorate of Industries & Commerce

|

District wise new MSME units started in Kerala in 2022-23 and 2023-24

The sector-wise growth of MSME units over the last five years reveals an increase in the number of agro and food-based units from 2,582 in 2019-20 to 23,474 in 2022-23. The number of service related MSME units has increased from 4,036 in 2019-20 to 38,006 in 2023-24. The number of units engaged in trade is also significant. The subsector-wise details of MSME units started in the last five years is given below:

|

Subsector wise details of new MSME units started in Kerala

|

|

Name of subsector

|

2019-20

|

2020-21

|

2021-22

|

2022-23

|

2023-24

|

|

Agro and Food- based

|

2,582

|

3,359

|

4297

|

23,474

|

6786

|

|

Textiles and Garments

|

1,904

|

1276

|

1564

|

14,702

|

1890

|

|

General /mechanical/light

Engineering

|

1,334

|

989

|

1193

|

1,988

|

549

|

|

Service Activities

|

4,036

|

2725

|

4097

|

24556

|

38006

|

|

Wood Products

|

5,32

|

436

|

517

|

1,529

|

688

|

|

Cement Products

|

3,09

|

233

|

368

|

0

|

0

|

|

Printing & Allied

|

2,80

|

188

|

198

|

3,795

|

2728

|

|

Paper Products

|

1,88

|

198

|

234

|

659

|

347

|

|

Information Technology

|

2,40

|

187

|

348

|

6,091

|

4957

|

|

Trade activity*

|

-

|

-

|

-

|

48,945

|

43869

|

|

Others

|

2,290

|

1949

|

2469

|

14101

|

3776

|

|

Total

|

13,695

|

11,540

|

15,285

|

1,39,840

|

1,03,596

|

|

Source: Directorate of Industries and commerce

*From 2022-23 onwards the data of trade activity included

|

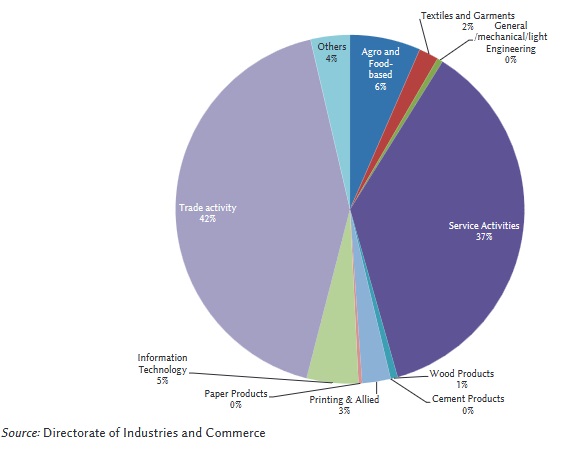

The top five subsectors together consist of over 80 per cent of the MSME units in the last five years. Trade Activity based units (42.4 per cent), Agro and food based (6.6 per cent) units and Service Activities (36.7 per cent) dominate in MSMEs. Units making plastic containers, gold ornaments, rubber products, handicrafts products are classified as “Others” (3.7 per cent). Textiles and garments (1.8 per cent), Information Technology (3.7 per cent) and General/Mechanical/Light Engineering (1 per cent) are the other leading subsectors. The share of each subsector is given below:

Subsector wise details of new MSME units in 2023-24

Export

Cashew:

India is among the largest cashew producing countries in the world. It employs large number of workers in the farms and factories. India exports cashews to more than 60 countries. As per the Directorate General of Commercial Intelligence and Statistics, the quantity of cashew export from India in 2023- 24 is 46,235 MT and the value is Rs 2,62,021 lakhs. This was 44,948 MT and Rs 2,71,800 lakhs in 2022-23. Cashew cultivation spread along the coastal regions of peninsular India. Kerala has an important role in production, processing, and export of cashew. The export of cashew kernels from Kerala increased to 22,753 MT in 2023-24, from 21,858 MT in 2022-23, registering a positive growth of 4 per cent over the same period last year.

The export of cashew nuts kernel whole and Cashew Nuts Fresh/Dried in Shell together contributes 64,582 Kilograms of export volume and Rs 276,659.4 lakhs value in 2023-24. This was 58,604 Kilograms in 2022-23 with the value of Rs 2,82,044.1 lakhs. The export of cashew items except Cashew nut shell liquid (CNSL), crude & Cashew kernel, broken from India shows an increasing trend in 2023-24.

|

Export of cashew kernels, 2016-17 to 2023-24, in Rs crore

|

|

Year

|

Kerala

|

India

|

Share of Kerala

(per cent)

|

|

|

Quantity (MT)

|

Value

(Rs crore)

|

Quantity (MT)

|

Value

(Rs crore)

|

Quantity

|

Value

|

|

2016-17

|

38,054

|

2,415.3

|

82,302

|

5,168.8

|

46.2

|

46.7

|

|

2017-18

|

36,930

|

2,580.4

|

84,352

|

5,871.0

|

43.8

|

44.0

|

|

2018-19

|

29,062

|

1,892.6

|

66,693

|

4,434.0

|

43.6

|

42.7

|

|

2019-20

|

30,478

|

1,742.5

|

67,647

|

3,867.2

|

45.1

|

45.1

|

|

2020-21

|

*23,368

|

NA

|

49,992

|

2,907

|

46.7

|

NA

|

|

2021-22

|

*24,299

|

NA

|

53,770

|

3,175.2

|

45.2

|

NA

|

|

2022-23

|

*21,858

|

NA

|

44948

|

2718

|

48.6

|

NA

|

|

2023-24

|

*22753

|

NA

|

46235

|

2620.2

|

49.2

|

NA

|

|

Source: Cashew Export Promotion Council of India/* Cochin Port Trust

|

Export of Coir and Coir Products

The export of coir and coir products from India is 12,32,097 MT in volume and the value is Rs 3,39,690.9 lakhs. This is a -2.6 per cent growth over the previous year's export of 12,64,784 MT of coir and coir products. The export of coir and coir products from Kerala through Cochin Port showed an increasing trend in 2023-24. The quantity exported through Cochin Port in 2023-24 was 2,96,137 MT and recorded a positive growth of 148.1 per cent over the previous year. The export of coir and coir products through Cochin Port in 2022-23 was 1,19,350 MT.

Export trend of coir and coir products from India and Kerala (through Cochin Port),

2017-18 to 2023-24, quantity in lakh MT

, 2017-18 to.jpg)

Export of Tea:

The export of tea from India in 2023-24 was 2,50,724 MT and the value for export was Rs 6,47,638 lakhs. This shows growth from 2,28,397 MT and a value of Rs 6,38,581 lakhs in 2022 23. Export of tea from Kerala ports in 2023-24 is 87,649 MT worth Rs 1,87,766 lakhs from 69,107 MT worth Rs 15,3,179 lakhs in 2022-23 registering a growth of 26.8 per cent in terms of quantity and 22.57 per cent in terms of value. The details are given below:

Export of tea from Kerala ports and India, 2019-23, quantity in MT, Rs In lakhs

|

Year

|

India

|

Kerala

|

|

Quantity

|

Value

|

Quantity

|

Value

|

|

2019-20

|

2,41,344

|

5,45,710

|

76,983

|

1,47,082

|

|

2020-21

|

2,03,791

|

5,31,153

|

70,398

|

1,56,595

|

|

2021-22

|

2,00,785

|

5,41,577

|

64,854

|

1,46,841

|

|

2022-23

|

2,28,397

|

6,38,581

|

69,107

|

1,53,179

|

|

2023-24

|

2,50,724

|

6,47,638

|

87,649

|

1,87,766

|

|

Source: Tea Board

|

Export of Coffee:

Export of Coffee In 2023-24, a total quantity of 3.8 lakh MT of coffee worth Rs 3618952 crores was exported from India as against 3.9 lakh MT of coffee worth Rs 3621549 crores in 2022-23 registering a growth of (-)2.6 per cent in quantity and -0.07 per cent in value. The export of coffee from Kerala through Cochin port shows a fall in quantity exported by 34211 MT and growth by (-) 27.6 per cent, in 2023-24 compared to 47245 MT volume and (-)23.9 per cent growth in the previous year.

Export of Spices:

In 2023-24, the export of spices and spice products from India was 15,39,692 MT valued Rs 36,95,880.5 lakhs as compared to 14,04,357 MT valued Rs 31,76,138 lakhs in the previous year. This registers a increase of 9.6 per cent in volume and an increase in value by 16.4 per cent. The export of spices from Kerala in 2023 24 was 1,19,434 MT and the value of export was Rs 6,41,092.9 lakh. This shows an increase in quantity traded by 7.5 per cent and value by 16.2 per cent over the previous year.

Export of spices, India and Kerala, from 2017-18 to 2023-24, quantity in MT and value in ₹ lakh

|

Year

|

Kerala

|

India

|

Kerala’s share

(per cent)

|

|

Quantity

(in MT)

|

Value

(Rs lakh)

|

Quantity (in MT)

|

Value

(Rs lakh)

|

Quantity

|

Value

|

|

2017-18

|

95,455.90

|

4,15,296.10

|

10,28,060

|

17,98,016.2

|

9.30

|

23.10

|

|

2018-19

|

89,590.80

|

3,78,560.40

|

11,00,250

|

19,50,581.1

|

8.10

|

19.40

|

|

2019-20

|

1,00,195.80

|

4,05,421.30

|

12,08,400

|

22,06,280.0

|

8.30

|

18.40

|

|

2020-21

|

1,21,348.90

|

5,00,633.60

|

17,58,266

|

30,96,771

|

6.90

|

16.20

|

|

2021-22

|

1,23,547.93

|

5,66,643.60

|

15,30,661

|

30,32,432.4

|

8.10

|

18.50

|

|

2022-23

|

1,11,080.13

|

5,51,521.02

|

14,04,357

|

31,76,138.2

|

7.90

|

17.36

|

|

2023-24

|

1,19,433.95

|

6,41,092.88

|

15,39,692

|

36,95,880.50

|

7.75

|

17.34

|

|

Source: Spices Board * Provisional

|

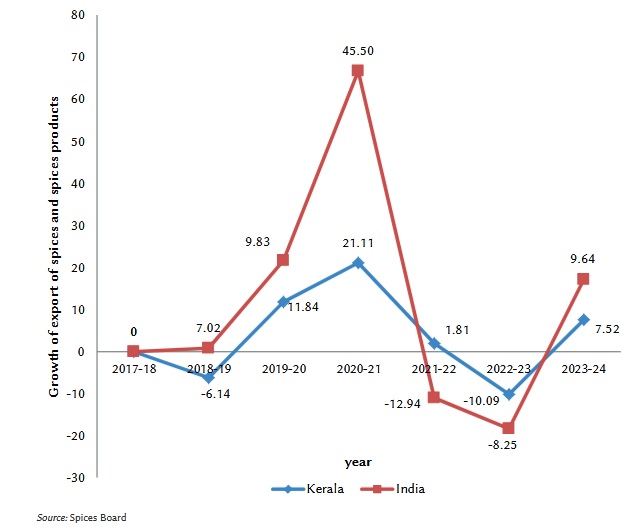

Kerala's export of spices and spice products, in quantitative terms, showed an increasing trend onwards 2018-19 and it continue up to 2020-21. A decline was registered during the year 2021-22. The year 2022-23 registered a negative growth of (-)10 and registered a positive growth of 7.5 for the year 2023-24. With regard to India's exports in spices shows negative growth for two consecutive years of 2021-22 and 2022-23 and then it shows a positive growth during the year 2023-24 (9.6 per cent). Figure depicts the trend in the growth of exports of spices and spice products from India and Kerala.

Trend in growth of export of spices and spice products from India and Kerala, 2017-18 to 2023-24, quantity in per cent

In 2023-24, the export of individual spices like cardamom small, cardamom large, ginger, fenugreek, mint products & miscellaneous spices from Kerala showed a decrease both in volume and value as compared to the previous year. A total volume of 4,001.4 MT of cardamom (small) valued Rs 698 crore was exported from Kerala in 2023-24 as against 4,345.1 MT valued Rs 550 crore in 2022-23. Export of chilli 28,867.18 MT valued Rs 906.3 crore in 2023-24 shows an increase from 25,717 MT valued Rs 659.7 crore from the previous year. The export of pepper increased to 15568 MT valued Rs 649.8 crores in 2023-24 as against 12,491.2 MT valued Rs 575.2 crores in 2022-23.

In the case of value-added products export of curry powder & mixture and spice oil & oleoresins products showed an increase in volume and value in 2023-24 in terms of quantity as compared to 2022-23. Export of curry powder and mixture in 2022-23 was 17,505.2 MT valued Rs 408.6 crore which rose to 18,663 MT valued Rs 504.5 crore in 2023-24 recording an increase in volume and value of export. Export of spice oil & oleoresins products in 2022-23 was 9766.4 MT valued Rs 2,365.4 crore which rose to 10,587.2 MT valued Rs 2,636.8 crore in 2023-24 recording an increase in volume and value of export.